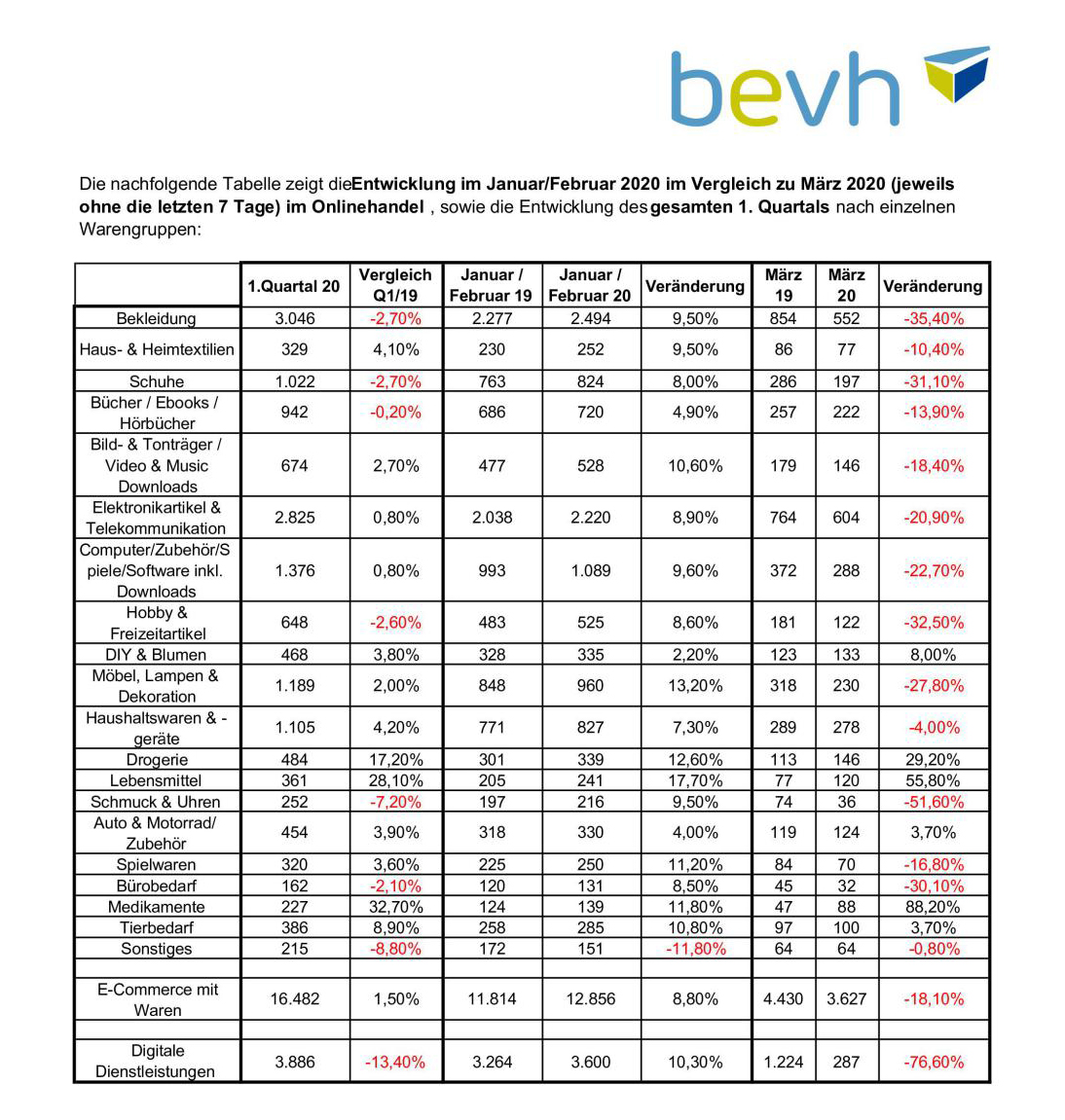

E-commerce collapsed by almost 20 percent in March 2020 compared to the same period in the previous year. Only the categories that were also in high demand in the retail sector were able to record significant increases in some cases: groceries, drugstores, medicines and do-it-yourself or hardware store ranges. Almost all of the growth that online retailing had achieved in January and February has been destroyed.

Online trade almost stagnated between January and March with a slight plus of 1.5 percent compared to the first quarter of 2019. The growth in the first quarter of this year was thus significantly below the strong prior-year figures of 11.2 percent. Between January and March 2020, customers bought goods for EUR 16,482 million including VAT (Q1 2019: EUR 16,244 million including VAT). In the first quarter of 2020, growth in the food category was 28.1 percent compared to the previous year and generated online sales of EUR 361 million including VAT (Q1 2019: EUR 282 million including VAT). In March alone, the increase was 55.8 percent. Medicines were sold in the 1st quarter of 2020 for EUR 227 millionVAT included (Q1 2019: EUR 171 million including VAT). Here, sales rose by 88.2 percent in March. In absolute growth, this small product group was the frontrunner.

In January and February, e-commerce sales rose by 8.8 percent to EUR 12,856 million including VAT. Numerous categories showed an unchecked increase of over 10 percent after years of growth. The large categories of clothing (+9.5 percent), consumer electronics (+8.9 percent) and computers / accessories (+9.6 percent) also continued to show very dynamic development. In March, sales fell across all categories by 18.1 percent. The clothing segment even crashed by more than 35 percent. Consumer electronics were down 20.9 percent, and computers and accessories were down 22.7 percent despite spending on home office solutions.

“E-commerce is now a normal shopping channel. That is why such a crisis in consumer sentiment has a full impact on our industry. The claim that e-commerce would emerge as a “winner” from the corona pandemic is simply wrong, ”says Gero Furchheim, President of the bevh and spokesman for the board of Cairo AG. "But it is correct that the opportunities of

e-commerce for the supply of customers and the business models of the retail trade are experienced anew."

In addition to the weekly consumer information, bevh has regularly asked its members about the business situation since the beginning of March. It was only in the last days of March, which could no longer be recorded in the consumer survey, that demand picked up, which, however, by no means made up for the accumulated loss in sales.

“Demand is picking up and this positive signal must also be returned to brick-and-mortar retail. That is why uniform approvals of contactless “Click & Collect” are now required - the contactless and secure transfer of goods ordered by telephone or online. In addition to online trading, this concept could now contribute to the security of supply for the population and the livelihood of stationary shops and must be part of a future exit strategy. The stores are full of goods and seasonal items are at risk of falling in value in the short term. ”

Product group cluster "Office supplies"

In the first quarter of 2020, online sales of office supplies fell to a total of EUR 162 million including VAT (Q1 2019: EUR 166 million including VAT). This is a decrease of 2.1 percent in the first quarter. In contrast, the loss in March 2020 compared to the comparable month of 2019 was 30.10 percent. The first two months of January and February 2020 had started well, at EUR 131 million including VAT compared to EUR 120 million including VAT in the previous year (corresponds to an increase of 8.5 percent).

Product group cluster "Leisure" ( DIY / flowers, toys, car / motorcycle / accessories, hobby / leisure items)

The total online sales of the product group cluster rose in the 1st quarter of 2020 to EUR 1,889 million including VAT (1st Q 2019: EUR 1,861 million including VAT) by a total of 1.5 percent.

Product group cluster "Furnishings" (furniture / lamps / decoration, house / home textiles, household goods / appliances)

In the 1st quarter of 2020, online sales rose to a total of EUR 2,623 million including VAT (Q1 2019: 2,542 Million EUR including VAT). This is growth of 3.2 percent in the first quarter.

Product group cluster "Clothing including shoes"

Clothing was purchased online in the 1st quarter of 2020 for EUR 3,046 million including VAT ( Q1 2019: EUR 3,132 million including VAT). Sales therefore fell by 2.7 percent compared to the previous year. The Shoes division generated online sales of EUR 1,022 million including VAT (Q1 2019: EUR 1,049 million including VAT). Here too, the change was minus 2.7 percent compared to the previous year.

Product group cluster "Entertainment" (books / ebooks / audio books, computers / accessories / games / software incl. Downloads, electronics / telecommunications)

Sales for computers, accessories and games only grew online in the 1st quarter 2020 by 0.8 percent and amounted to EUR 1,376 million including VAT (Q1 2019: EUR 1,366 million including VAT). Online sales of books and e-books were EUR 942 million including VAT (Q1 2019: EUR 944 million including VAT) and fell by 0.2 percent.

Merchandise group cluster "Daily Requirement" (food, drugstore, animal supplies)

The total volume of the Merchandise Category Cluster "Daily Requirement" increased online by a total of 17.3 percent with a total turnover of EUR 1,231 million including VAT (Q1 2019: EUR 1,050 million including VAT). Sales at drugstores alone increased by 17.2 percent compared to the previous year.

Services

E-commerce services suffered dramatic losses, which are characterized in particular by online bookings for travel, events or flight, bus and train tickets. In March alone, they fell by more than 75 percent in sales compared to the same period in the previous year. In the entire 1st quarter of 2020, they generated EUR 3,886 million including VAT, 13.4 percent less sales than in 2019 ( EUR 4,489 million including VAT).

Types of senders in e-commerce trade

In the 1st quarter, pharmacy senders moved forward. This category grew by 25 percent compared to the previous year and achieved online sales of EUR 200 million including VAT (Q1 2019: EUR 160 million including VAT). The biggest losses were suffered by the online shops of stationary retailers, which fell by 9.5 percent to EUR 2,047 billion including VAT (Q1 2019: EUR 2,263 billion including VAT). Growth of 4.9 percent compared to the previous year and sales of EUR 8,011 million including VAT (Q1 2019: EUR 7,639 millionVAT) generated the online marketplaces. In percentage terms, Internet Pureplayers were also on par with an increase of 4.9 percent and sales of EUR 2,395 million including VAT (Q1 2019: EUR 2,283 million including VAT).

In the entire interactive trade (online and classic mail order business), German consumers bought goods for EUR 16,785 million including VAT in the 1st quarter of 2020 (Q1 2019: EUR 16,740 million including VAT). Online retail accounted for 98.2 percent of this and increased overall by 1.2 percentage points compared to the same quarter of the previous year.

Every third online buyer now orders several times a week on the Internet. This and a significantly increased order volume via mobile devices drove gross sales of goods in e-commerce to EUR 72.6 billion in 2019, including VAT. This is an increase of 11.6 percent over the previous year's figure of 65.1 billion EUR includes incl. VAT. Total sales of goods and services in interactive commerce, in addition to online sales also written and telephone orders, reached in 2019 94 billion EUR VAT included

About the study:

The Bundesverband E-Commerce und Versandhandel Deutschland eV (bevh) conducts the consumer survey "Interactive Trade in Germany" for the sixth time in a row. Since 2018 with the new partner BEYONDATA GmbH. From January to December, the study surveyed 40,000 private individuals from Germany aged 14 years and older about their spending behavior in online and mail order business and their consumption of digital services (e.g. in the area of travel or ticketing). The final result of the study will be published in early 2021 after the survey is completed. The figures presented today are based on an evaluation of the months from January to March 2020.

From:PBS report, Germany