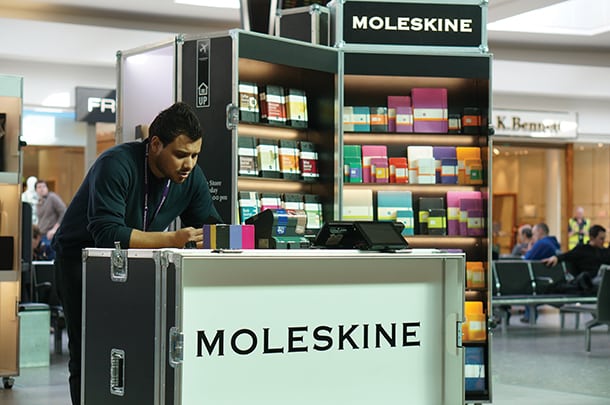

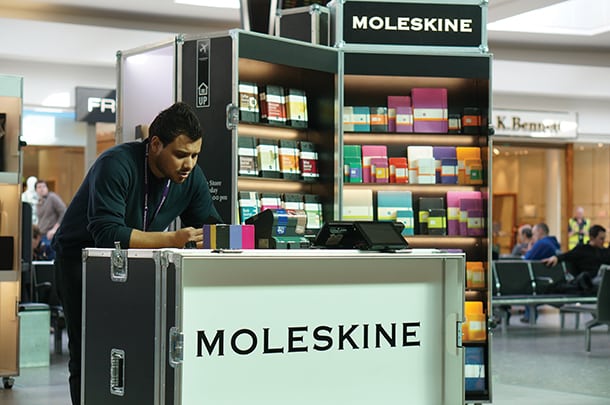

Following a decline of 18% in the first quarter, high-end stationery vendor Moleskine returned to growth in Q2.

The company’s sales for the first six months of the year were €71.1 million ($78 million), a year-on-year constant currency decline of 5.2%. Revenue grew in the double digits in the second quarter after the 18% drop in Q1 that was due to exceptionally large B2B orders in the first quarter of 2018.

· Wholesale (61% of total): Up by 3.9% with growth reported across all regions. Growth in EMEA was driven by positive momentum in Italy and Spain and continued strength of bag sales. US sales were underpinned by online retailers and the launch of back-to-school programmes. The Canadian operations benefited from the rollout of a visual merchandising programme at a key retailer. APAC’s double-digit growth was driven by trade marketing initiatives at leading Japanese retailers, and online bag sales.

· B2B (19% of total): A drop of 27.9% at constant exchange rates, reflecting the large orders received in H1 2018 in EMEA and APAC. Sales were more than 30% higher than in H1 2017.

· Retail (14% of total): A decrease of 6.1% partly due to a reduction in the store network from 80 to 78. Like-for-like store sales growth was slightly negative as weak in-store traffic was only partially offset by improved conversion and a higher average transaction value. The bags category continued to show double-digit growth.

· E-commerce (4% of total): Sales were flat, with growth in EMEA and Americas offset by a drop in APAC. Moleskine said it had experienced some fulfilment issues with a major customer, but was addressing these.

· Americas (41% of total): An increase of 2.7% driven by double-digit growth in Wholesale and B2B.

· EMEA (45% of total): The 11.2% drop was due to the large B2B orders in H1 2018. The other channels achieved growth.

· APAC (14% of total): Down by 8.1%, with growth in Wholesale more than offset by a drop in B2B, Retail and E-commerce.

Moleskine’s H1 operating profit was €2.7 million, a year-on-year decline of almost 50% due to the top-line decrease. However, the performance improved significantly towards the end of the reporting period with an operating result of €5.5 million in June.

In May, Moleskine acquired Edo.io, one of the start-ups from its Open Innovation programme. Based in Italy, Edo.io is the maker of the Edo Agenda, a digital planner service which is designed to enable user productivity and creativity.

In its outlook for the rest of the year, Moleskine said it expected sales and profit growth to accelerate due to a number of factors: mid-single-digit revenue growth in the Wholesale channel; an improving top-line in the B2B channel driven bya solid order book; and the seasonal uplift in the Retail and E-Commerce segments.

The company’s sales for the first six months of the year were €71.1 million ($78 million), a year-on-year constant currency decline of 5.2%. Revenue grew in the double digits in the second quarter after the 18% drop in Q1 that was due to exceptionally large B2B orders in the first quarter of 2018.

H1 2019 sales by channel:

· Wholesale (61% of total): Up by 3.9% with growth reported across all regions. Growth in EMEA was driven by positive momentum in Italy and Spain and continued strength of bag sales. US sales were underpinned by online retailers and the launch of back-to-school programmes. The Canadian operations benefited from the rollout of a visual merchandising programme at a key retailer. APAC’s double-digit growth was driven by trade marketing initiatives at leading Japanese retailers, and online bag sales.

· B2B (19% of total): A drop of 27.9% at constant exchange rates, reflecting the large orders received in H1 2018 in EMEA and APAC. Sales were more than 30% higher than in H1 2017.

· Retail (14% of total): A decrease of 6.1% partly due to a reduction in the store network from 80 to 78. Like-for-like store sales growth was slightly negative as weak in-store traffic was only partially offset by improved conversion and a higher average transaction value. The bags category continued to show double-digit growth.

· E-commerce (4% of total): Sales were flat, with growth in EMEA and Americas offset by a drop in APAC. Moleskine said it had experienced some fulfilment issues with a major customer, but was addressing these.

H1 2019 sales by region:

· Americas (41% of total): An increase of 2.7% driven by double-digit growth in Wholesale and B2B.

· EMEA (45% of total): The 11.2% drop was due to the large B2B orders in H1 2018. The other channels achieved growth.

· APAC (14% of total): Down by 8.1%, with growth in Wholesale more than offset by a drop in B2B, Retail and E-commerce.

Moleskine’s H1 operating profit was €2.7 million, a year-on-year decline of almost 50% due to the top-line decrease. However, the performance improved significantly towards the end of the reporting period with an operating result of €5.5 million in June.

In May, Moleskine acquired Edo.io, one of the start-ups from its Open Innovation programme. Based in Italy, Edo.io is the maker of the Edo Agenda, a digital planner service which is designed to enable user productivity and creativity.

In its outlook for the rest of the year, Moleskine said it expected sales and profit growth to accelerate due to a number of factors: mid-single-digit revenue growth in the Wholesale channel; an improving top-line in the B2B channel driven bya solid order book; and the seasonal uplift in the Retail and E-Commerce segments.